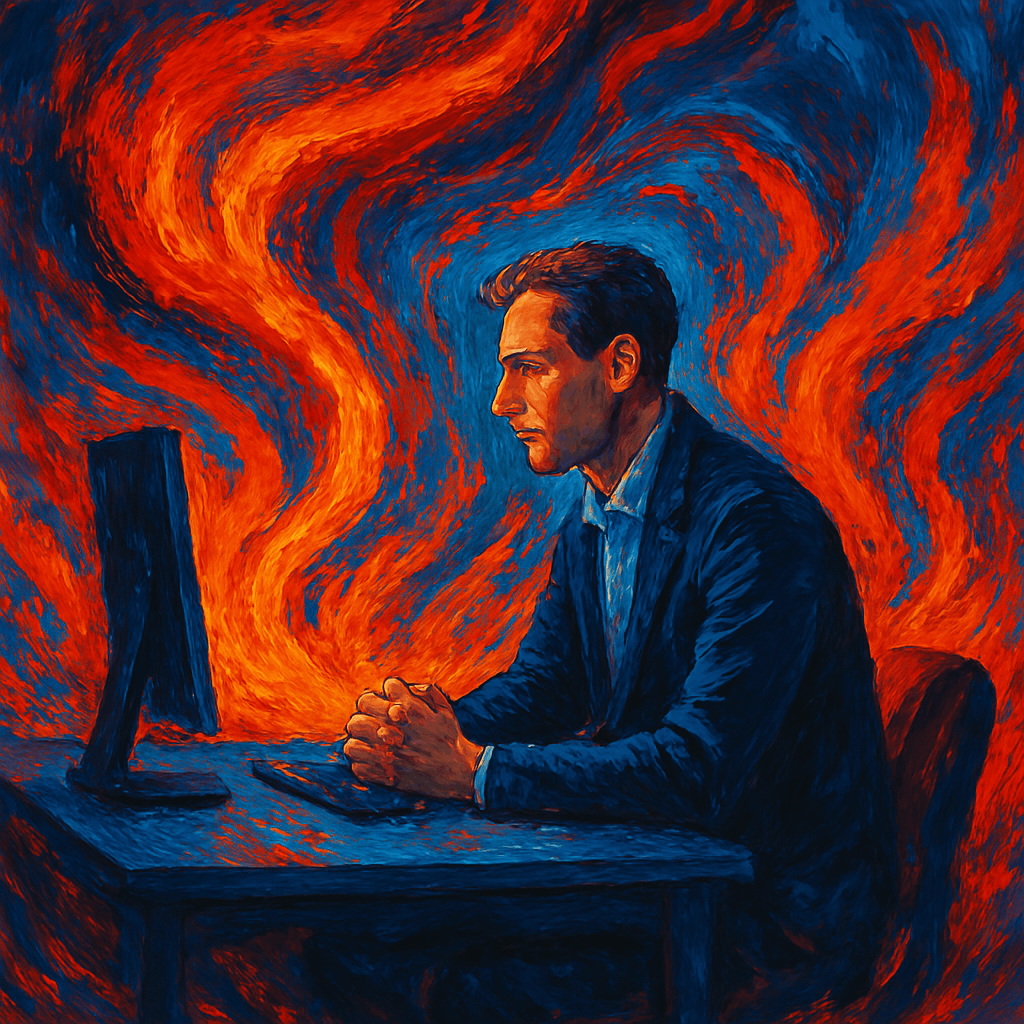

Most people who dream about trading picture it as fast-paced, thrilling, and loaded with adrenaline. There’s something undeniably seductive about the idea of making a quick fortune, placing bets, and watching money flood your account. But here’s the uncomfortable truth—if trading feels exciting, you’re probably doing it wrong.

💰 Why Do People Find Trading Exciting?

For many, it’s the allure of chasing money. Trading holds the promise of quick riches, transforming life overnight. The possibility alone triggers intense emotions—hope, greed, and even fear—creating a cocktail of adrenaline that’s incredibly addictive. It isn’t really the process of trading itself that’s captivating; it’s the promise of instant wealth that hooks people.

This allure is amplified by psychological phenomena such as loss aversion, where traders disproportionately feel the sting of losses. This often pushes them to make impulsive decisions, hoping to quickly recover losses, which heightens excitement and risk-taking.

My own story: More than 10 years ago, I had about a $25,000 trading account and had grown it to around $45,000 trading the ES. I then took a significant loss—one that created a pit in my stomach I couldn’t shake. Instead of pausing to regain my composure, I kept trading, driven by emotion and desperation. Eventually, I lost the entire account. It was one of the hardest and most insightful lesson I’ve ever learned in trading. One that I don’t ever want to see anyone else learn through a similar experience—this article is written from personal experience, not what others have told me.

🎲 The Thrill of the Unknown

Another reason trading feels exciting is our innate attraction to uncertainty—the thrill of stepping into the unknown. Every trade represents a leap into ambiguity: will you win big or lose everything? That unpredictability mirrors the excitement of gambling, lighting up the same neural pathways as spinning a roulette wheel or placing a risky bet in a casino.

This attraction makes traders especially susceptible to psychological traps like the gambler’s fallacy. After consecutive losses, traders might irrationally believe a winning trade is imminent, prompting them to take larger, riskier positions, intensifying their emotional commitment and heightening their excitement. In my personal experience above, it was precisely this trap that kept me trading impulsively, chasing the elusive win that never came.

🤔 Trading Without Confidence

Excitement also intensifies when traders lack confidence in their methods. Without a trusted system or clearly defined edge, each trade feels uncertain, akin to flipping a coin. This uncertainty generates anxiety, pushing traders to desperately search for reassurance rather than objectively assessing market signals.

This insecurity naturally feeds into confirmation bias. Traders who lack confidence often selectively seek out information that aligns with their desired outcomes, reinforcing flawed decisions. They dismiss critical warnings, creating a feedback loop of emotional decision-making that further amplifies excitement and potential risk. Reflecting back, I realize that during my most significant loss, I fell deep into confirmation bias, ignoring clear signals that would have told me to step away and reset.

⚙️ Why Profitable Trading Should Be Boring

Real traders, those consistently profitable in the long run, know trading shouldn’t feel like a thrill ride—it should feel mundane. Profitable trading isn’t about chasing big wins; it’s about methodically executing proven strategies day in and day out. Professional traders treat the market like a disciplined job, where repetition, patience, and boredom are virtues. They don’t actively seek excitement because excitement often signals risk, instability, and impulsivity.

Yet, even disciplined traders experience excitement occasionally—but it’s fundamentally different. Their excitement comes from seeing their disciplined system consistently working, not from unpredictable, emotionally charged trades.

🔄 Embracing the Routine

Embracing the routine means proactively minimizing emotional responses and excitement from your trading. You might achieve this by:

- Developing and consistently following a clear trading plan.

- Managing risk through predefined stop-losses and position sizes.

- Conducting thorough trade reviews to reinforce discipline.

- Using checklists or rituals before entering a trade to ensure emotional preparedness.

Additionally, cultivating patience is vital—recognizing that not every day or week will be a big win and accepting small, consistent gains as significant progress. Mindfulness techniques, like brief breathing exercises or quick self-check-ins, can also help reduce impulsive behaviors driven by emotion.

To gauge if you’re potentially ready to trade, you might consider:

- Feeling calm, composed, and detached from immediate outcomes.

- Having clearly defined entry and exit criteria before entering any trade.

- Recognizing when emotions are heightened—maybe you’re anxious or overly eager—and consciously stepping back until you’ve regained composure.

Routine, patience, and emotional self-awareness ultimately create a protective barrier against impulsivity. The more structured and predictable your approach, the fewer emotional swings you’ll experience.

📌 Reflecting on Your Trading Approach

If trading consistently feels thrilling, it’s time to reflect. Are you chasing money instead of consistency? Are you gambling, driven by uncertainty rather than a proven strategy? It’s only when trading becomes routine—predictable, disciplined, and yes, even boring—that you truly begin to master it (we never really master it).

Ultimately, trading should feel less like a casino and more like operating a well-oiled machine. If you seek excitement, consider skydiving. But if lasting success is your goal, it’s time to embrace the healthy boredom of professional trading.

🎉 Prop Trading Discounts

💥91% off at Bulenox.com with the code MDT91