Automated trading has revolutionized the financial markets by allowing traders to execute strategies without manual intervention. This approach offers numerous benefits, including efficiency, speed, and the ability to capitalize on market opportunities around the clock. Hawk Tradings, a company focused on leveraging these benefits, has introduced “The Hawk,” an automated trading bot designed specifically for the Nasdaq futures market. This blog post will explore the capabilities of “The Hawk” and evaluate how it can enhance trading experiences for both novice and experienced traders.

I have no affiliation with Hawk Tradings; this review is based on independent research and personal opinion.

About Hawk Tradings

Hawk Tradings is a company focused on providing automated trading solutions for the futures market, specifically targeting Nasdaq futures (NQ/MNQ). Their main product, “The Hawk,” is a fully automated trading bot designed to execute trades based on user-defined strategies, offering a hands-free trading experience. The company emphasizes simplicity, efficiency, and the potential to optimize trading performance through automation.

For more detailed information, including how to get started with “The Hawk,” you can visit their website: Hawk Tradings.

“The Hawk” Trading Bot

“The Hawk” trading bot by Hawk Tradings is an advanced, fully automated solution designed for trading Nasdaq futures (NQ/MNQ). Built to provide a seamless, hands-free trading experience, it uses predefined strategies to analyze market trends and execute trades. The bot incorporates various technical indicators to make trading decisions.

Key properties of the bot include:

- StartTime and EndTime: Define the trading session’s start and end times (e.g., 9:30 AM to 4:00 PM).

- Take Profit and Stop Loss: Parameters for profit targets and stop losses.

- Max Profit and Max Loss: Limits for daily profit and loss to manage risk.

- Offsets: Adjustments for entry points relative to current prices.

- Market or Limit Order Option: Users can choose between using market orders for immediate execution or limit orders for price-specific trades.

For paid members, Hawk Tradings provides additional rules on adjusting trade times each day, especially to avoid trading around significant news events, ensuring that trades are made under optimal conditions. This feature is particularly beneficial for managing risk during high-volatility periods.

To learn more about “The Hawk” trading bot and how to implement it in your trading strategy, visit Checkout for The Hawk Trading Bot.

How Much Does It Cost?

Hawk Tradings offers “The Hawk” automated trading bot for a one-time fee of $3,500.00 USD. This purchase provides access to the bot’s full range of features and their member only area of Discord.

For more details and to purchase “The Hawk,” you can visit Hawk Tradings website.

What Trading Platforms Does It Work With?

“The Hawk” trading bot is designed to work with NinjaTrader, a popular trading platform known for its powerful charting, market analysis, and automated trading capabilities.

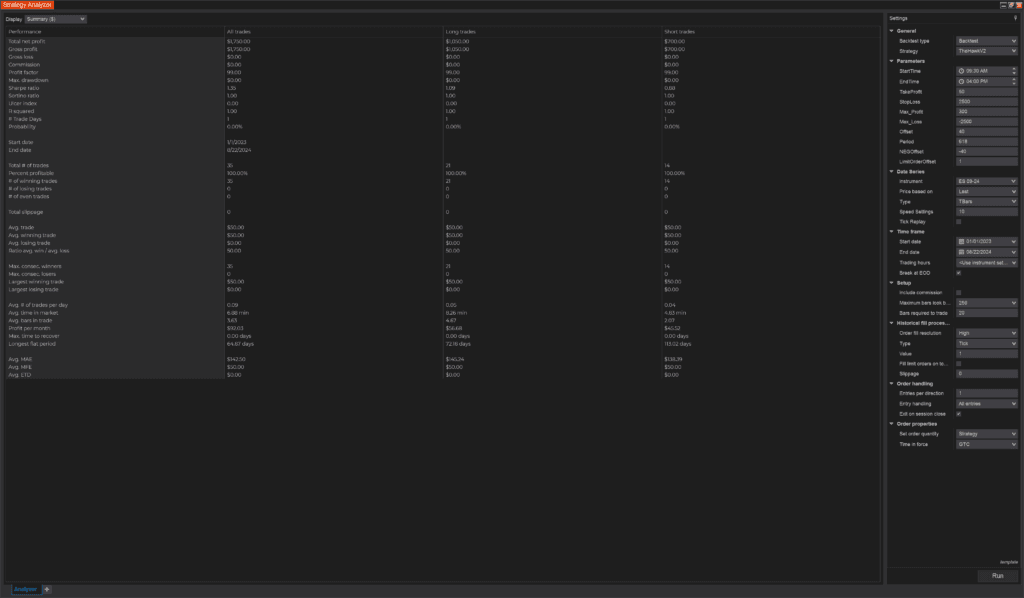

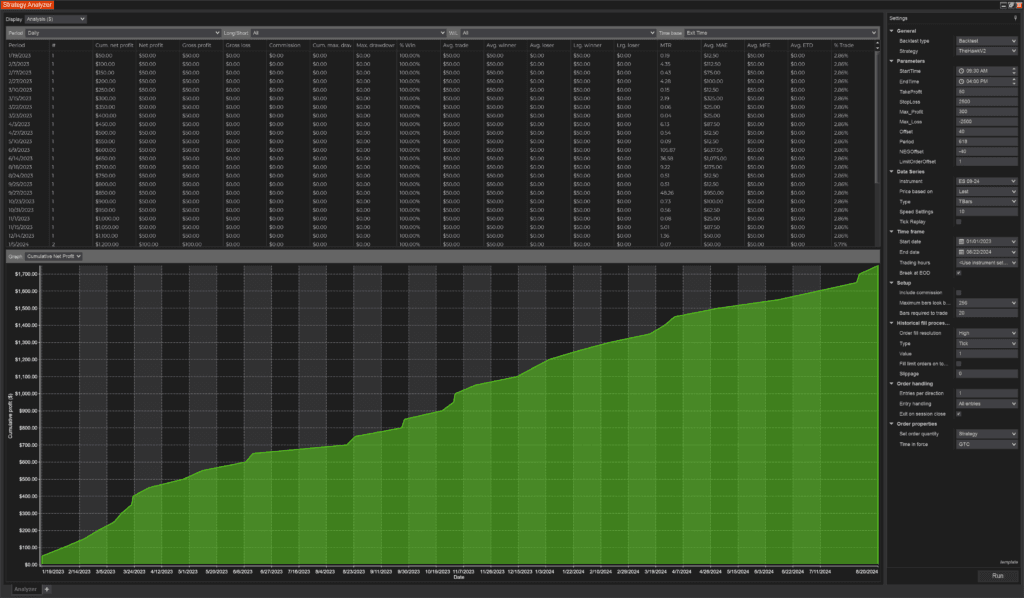

Backtesting Results: Evaluating “The Hawk” Trading Bot Performance

Backtesting is an important step in assessing the effectiveness of any trading strategy (even if it’s a manual backtest). By analyzing historical market data, we can gauge how “The Hawk” would have performed and then can infer how it might perform in the future. Considering the price of $3,500, most potential users would expect to see detailed backtesting results to understand the bot’s reliability, profitability, and risk management capabilities. This section will explore those results to provide additional insights into the bot’s performance.

Before purchasing any trading product, including “The Hawk,” traders should conduct their own research and due diligence. It’s important to understand the risks involved and ensure the product aligns with your trading strategies and risk tolerance.

Backtesting the NQ

In this sub-section, we’ll outline the thought process behind backtesting “The Hawk” on the Nasdaq futures (NQ). Due to some of the member-only rules, there will be times when the bot is not activated, or settings are adjusted. For instance, many trading systems advise against trading around major news events to avoid high volatility.

The plan is to conduct an initial backtest from January 1st to August 21st without adjusting any settings. Afterward, we will review the days that underperformed and apply additional rules, such as avoiding trading during key news events, to refine the results. This approach will give us a more realistic idea of how the bot might perform with these extra safeguards in place.

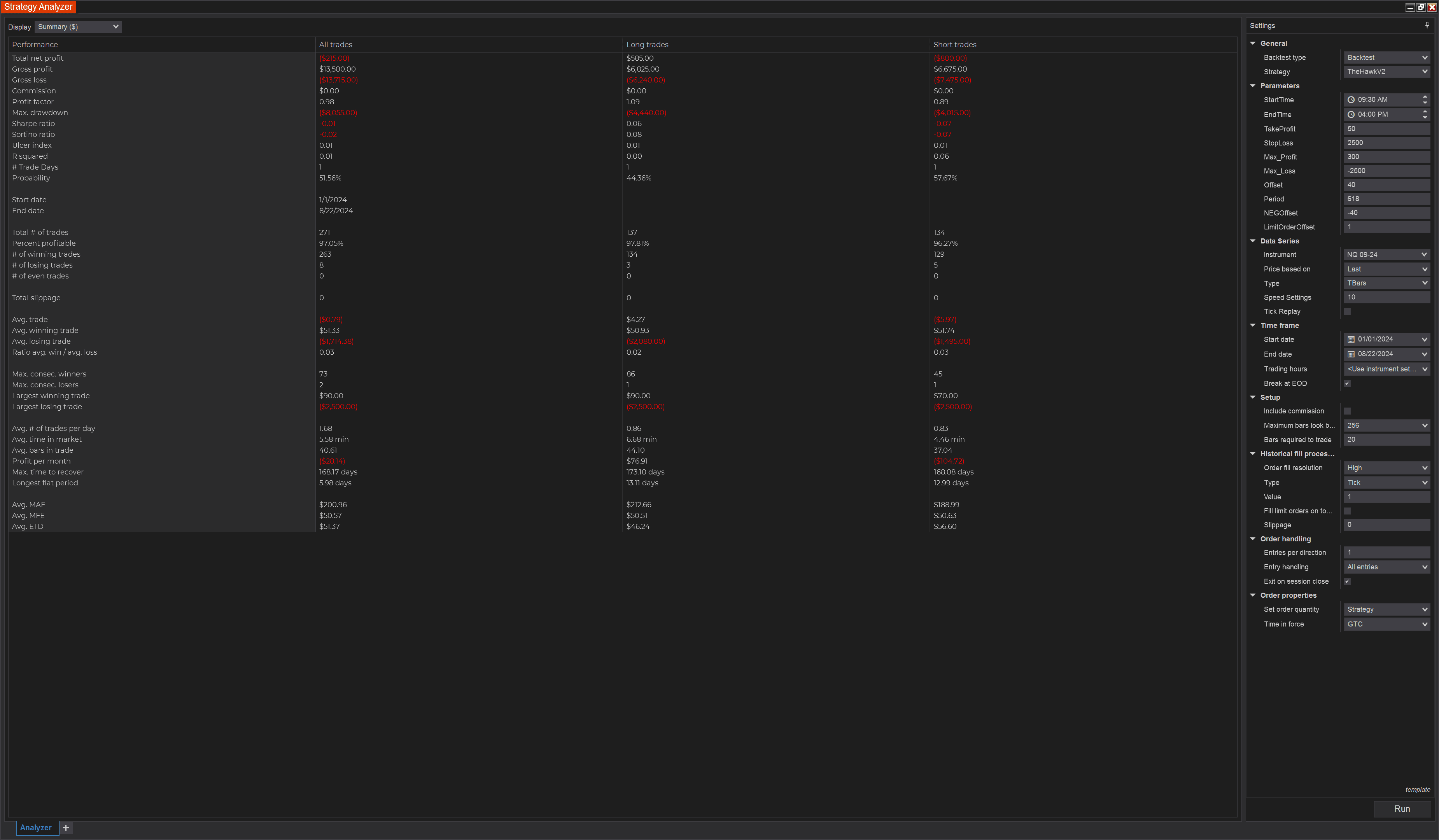

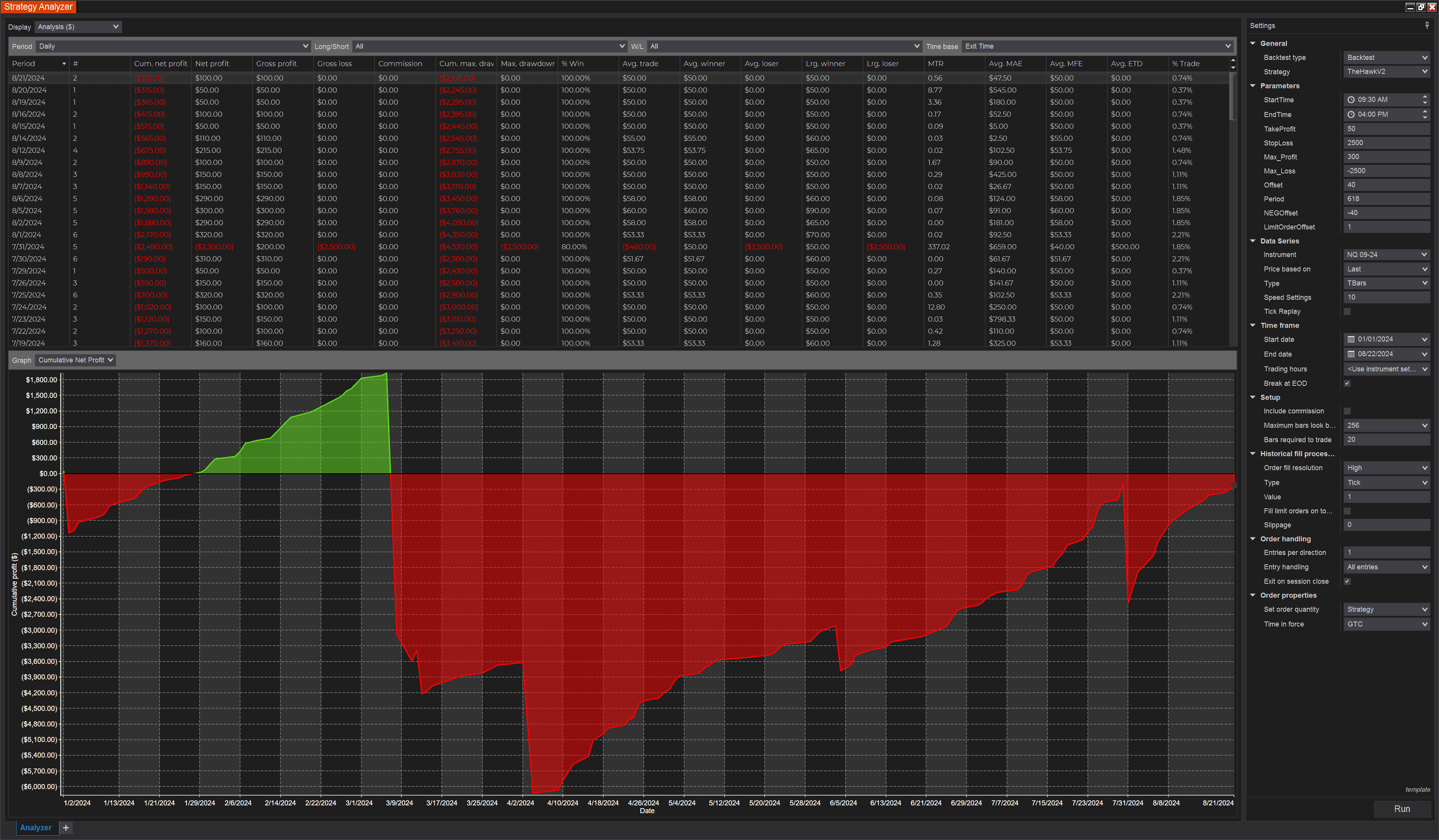

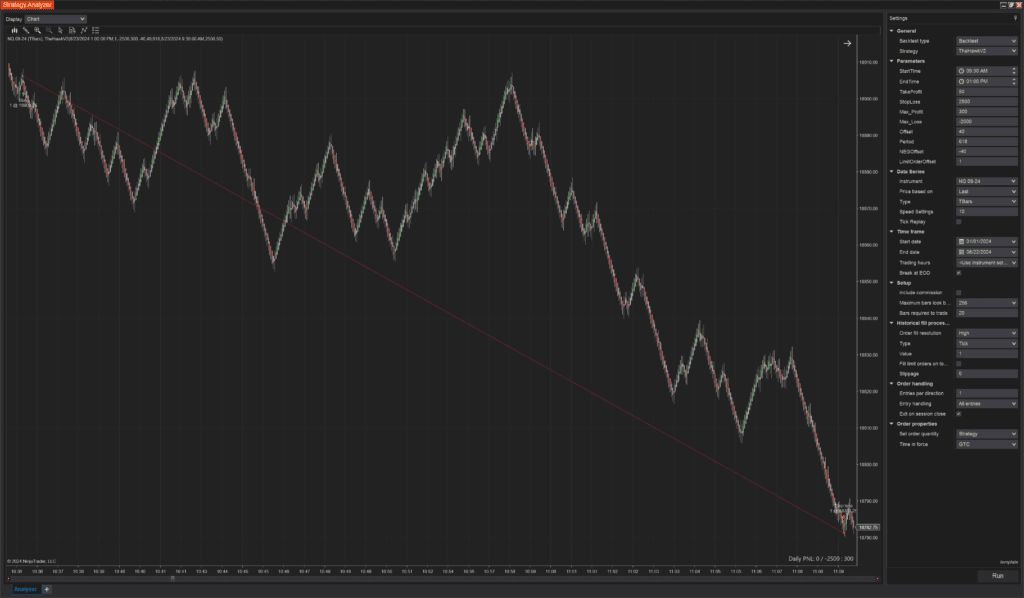

Let’s run our first NQ backtest:

Obviously, this first backtest does not look great. However, if we look at the trades that were losers and only look at entry times for those trades, we’ll notice that a lot of them happen after 2:00 PM EST. Personally, I would never be online or monitoring an automated bot at that time, so I re-ran the backtest with an end time of 1:00 PM EST.

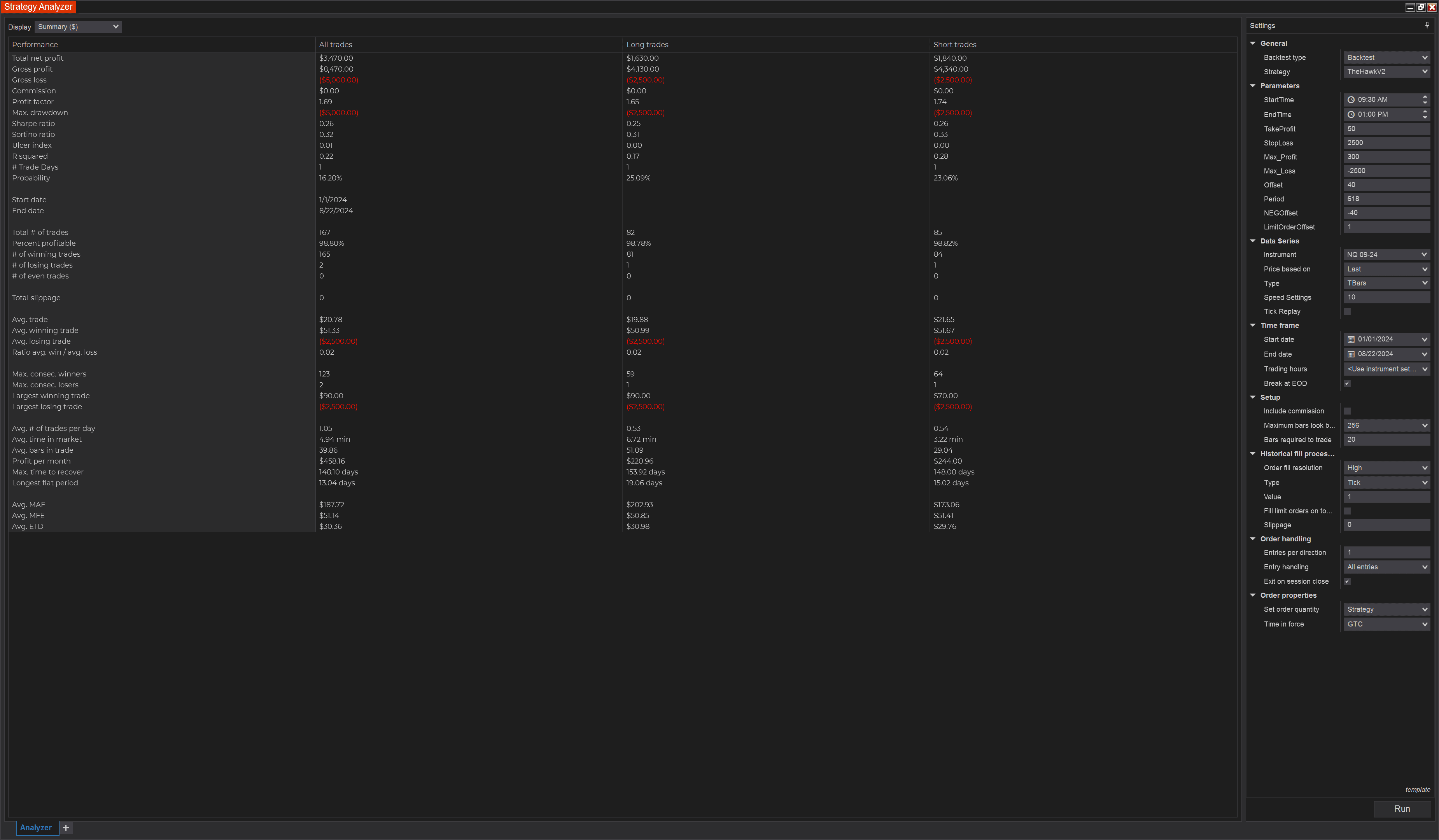

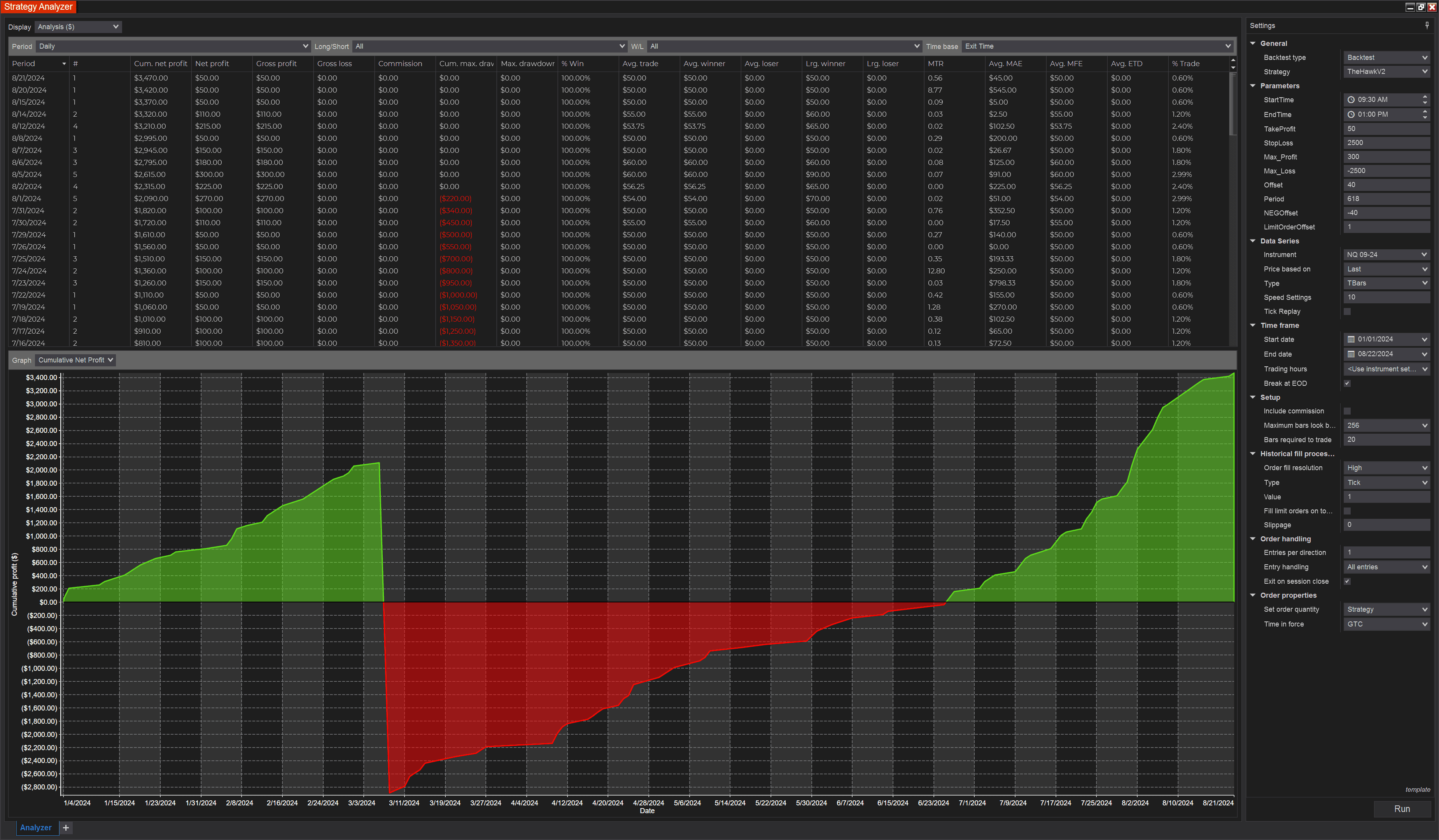

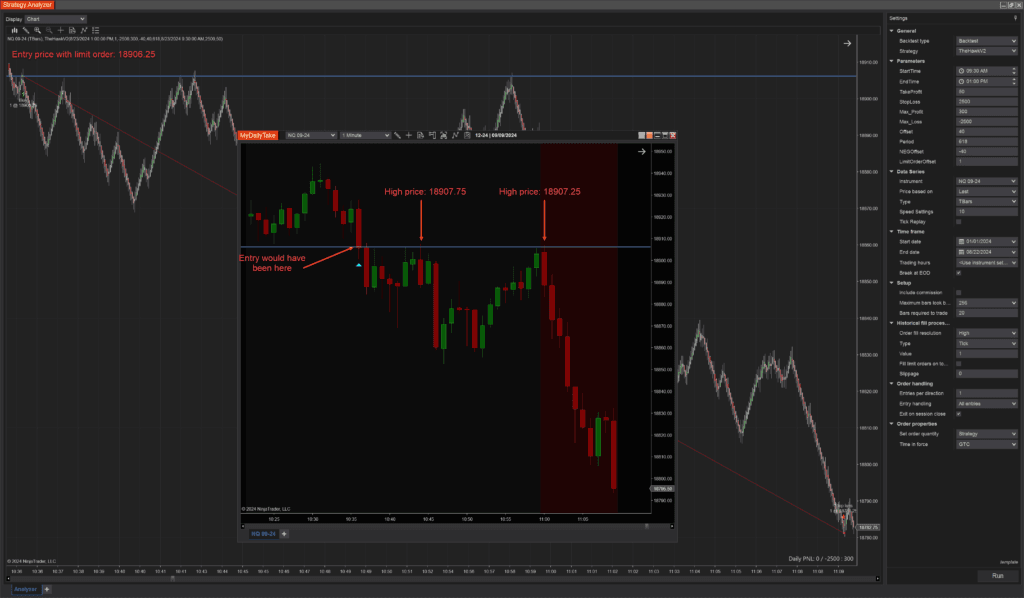

Let’s run our second NQ backtest with an adjust end time of 1:00 PM EST:

Things are starting to look a lot better, but there are still two days that are not profitable. Let’s take a closer look at those days:

- 3/7/2024 – On this day, the entry around 9:48 AM EST resulted in a loss. However, if we examine that day’s events, there was a high-impact news event, Fed Chair Powell Testifies, scheduled for 10:00 AM EST. Under the typical rules for avoiding major news events, the bot would have been turned off during this period. Therefore, this loss can be considered a false positive, as it would not have occurred under normal operating conditions.

- 3/8/2024 – On this day, the entry around 10:36 AM EST resulted in a loss.

The loss on 3/8/2024, we should explore in a little more detail. Here is the raw trade:

When we examine this trade more closely, there were at least two opportunities to exit with a 1-tick profit, which could cover the commission costs. These opportunities are marked in the image below, but to avoid this loss in real-time, certain adjustments would be necessary. First, active monitoring of the bot is crucial (as it’s not advisable to let a bot run unmanaged). Secondly, knowing that most winning trades don’t have significant intra-trade drawdowns, when experiencing a large drawdown, it would be wise to aim for a minimal profit exit, such as 1 tick, rather than holding out for the original target. In the image below, I marked-up a 1 minute chart so you could see true price action and not the synthetic price action of the other renko styke bars.

Backtesting the ES

I know the strategy was specifically developed for the Nasdaq futures (NQ), but I couldn’t resist the urge to see how it performs on the S&P 500 futures (ES). So, I ran a backtest on the ES using the same bar type as the NQ. By doing this, we can get a sense of the strategy’s flexibility and how well it might adapt to different market environments. The results will help us understand if “The Hawk” can be effective beyond its original design.

Conclusion

Based on reviewing the backtesting results, considering the rules, and adjusting for larger-than-normal intra-trade drawdowns, I would consider taking this bot “live” in one or more of my prop trading accounts (I will forward test for a bit first). The strategy has shown promise, especially when actively monitored and adjusted according to market conditions.

However, it’s important to remember that each trader is different and unique. Decisions to use any trading bot, including “The Hawk,” should be based on individual research, trading style, risk tolerance, and personal comfort with automated trading strategies. Make sure to thoroughly evaluate and test any trading tool before committing real capital.

🎉 Prop Trading Discounts

💥91% off at Bulenox.com with the code MDT91

Today (8/23/2024) was the first day forward testing this system. I ran the system on Sim and it was up $100 (gross) on the NQ before I shut down NinjaTrader for the day.